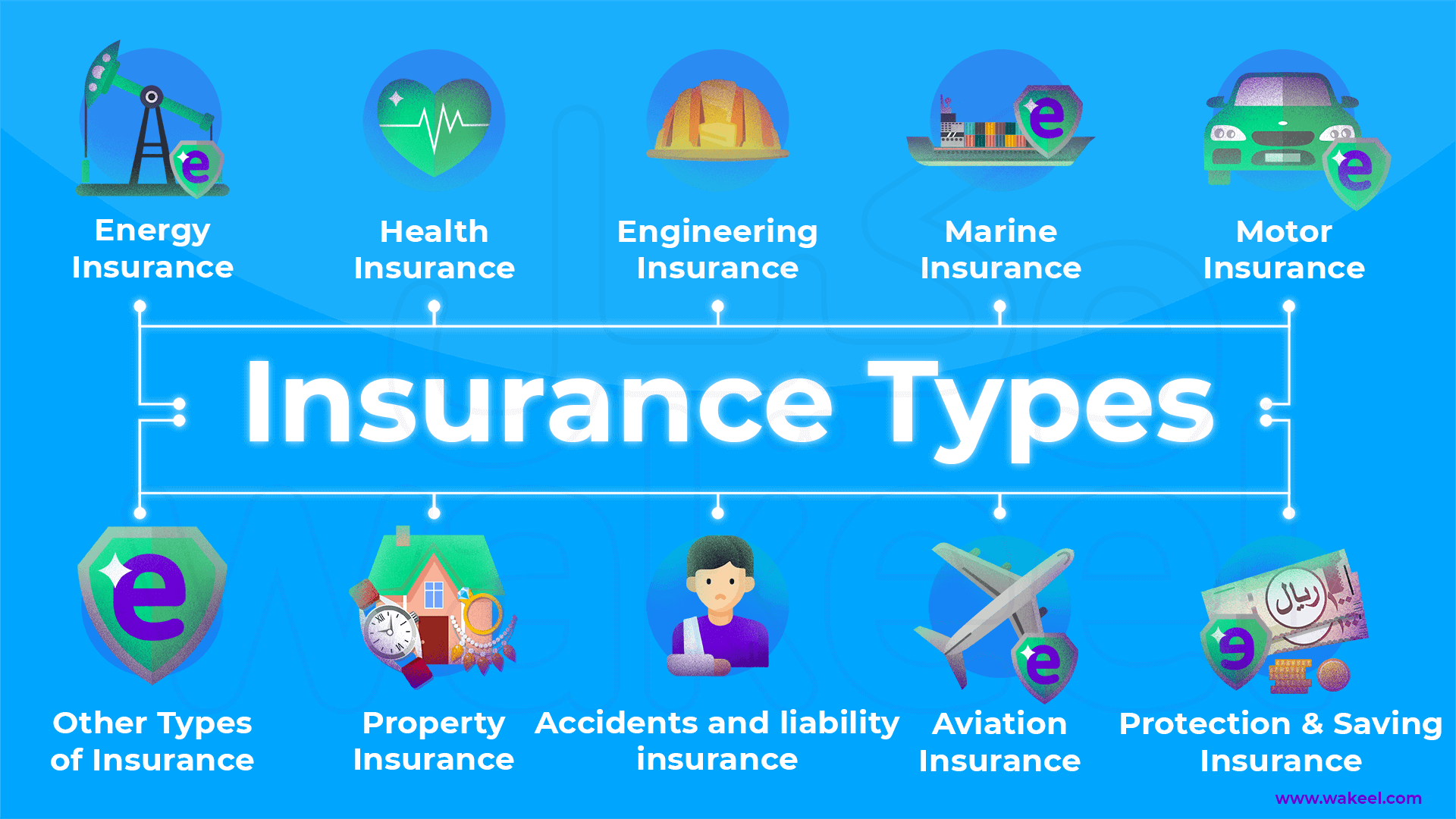

WORLD BEST INSURANCE POLICY | HEALTH INSURANCE | ENERGY INSURANCE | AVIATION INSURANCE |

The "world's best insurance policy" will vary from person to person since it depends on individual needs, preferences, and the type of coverage required. Here are some factors to consider when looking for a high-quality insurance policy:

1. Coverage: The policy should offer comprehensive coverage that meets your specific needs. This might include health insurance, life insurance, car insurance, property insurance, etc.

2. Financial Strength: Choose an insurance company with a strong financial standing and a good reputation. Check their credit ratings and reviews to ensure they are capable of fulfilling their obligations when a claim arises.

3. Claims Process: Look for an insurer known for a smooth and efficient claims process. A good insurance company should handle claims promptly and fairly.

4. Customer Service: Good customer service is essential when dealing with insurance matters. Research the insurer's reputation for customer support and responsiveness.

5. Affordability: While you want comprehensive coverage, it's crucial to find a policy that fits within your budget.

6. Policy Terms and Conditions: Read the fine print of the policy to understand its terms and conditions. Pay attention to exclusions, limitations, and any special conditions that may apply.

7. Add-on Riders: Some insurance policies allow you to customize coverage with add-on riders. Consider if these riders add value to your policy.

8. Network Coverage (for health insurance): If you're looking for health insurance, check the network of healthcare providers to ensure convenient access to medical services.

9. Online Tools and Resources: A good insurance company might provide helpful online tools and resources to manage your policy and claims efficiently.

To find the best insurance policy for your specific needs, it's essential to research and compare multiple insurance providers. You can seek advice from insurance brokers or financial advisors who can help you navigate through the options and find a policy that suits you best. Remember, what might be the best policy for one person may not be the same for another, so tailor your choice to your unique circumstances.

0 Comments